income tax calculator philippines

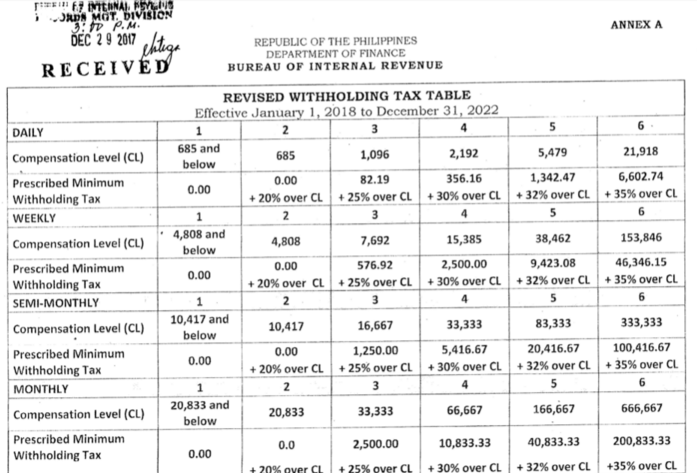

All you need to do is select your salary period and civil status and provide the figures for the different fields. To access Withholding Tax Calculator click here.

How To Compute The Income Tax Due Under The Train Law Cpa Davao Accounting Tax Business

Income Tax Calculator The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

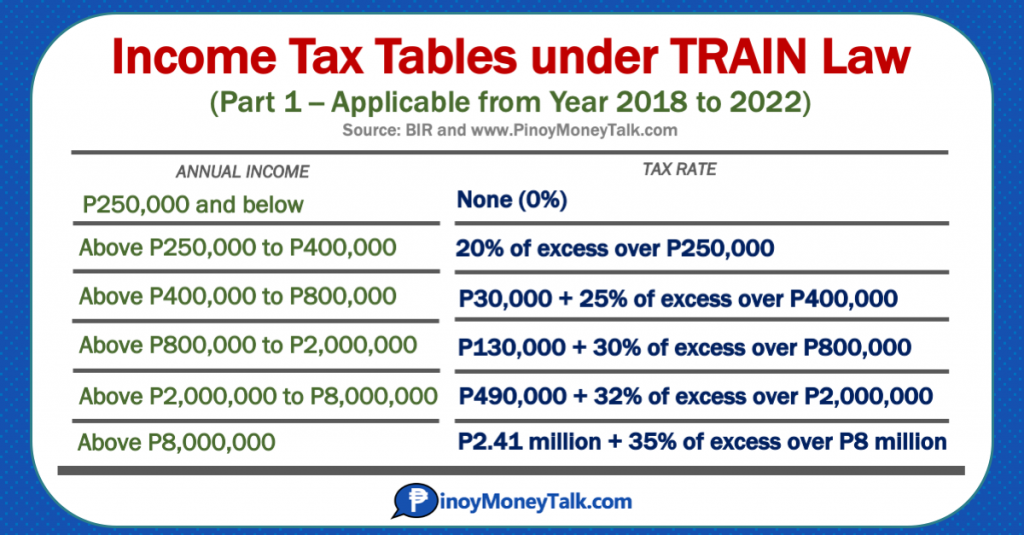

. Feb 22 2022 The Philippines income tax rates and allowances Calculator is an online tool that can estimate your tax liability. Tax Changes You Need to Know on RA 10963 TRAIN 2017 Philippine Capital Income and Financial Intermediation Statistics. Withholding Tax on Compensation in the Philippines Income tax in the Philippines is levied by the Philippine government on both personal and corporate.

Income tax law provided in Tax Code of 19997 governs income tax procedures in Philippines resident. It takes into account various data such as. The contributions for PhilHealth is.

For inquiries or suggestions on the Withholding Tax. Many Australians will pay less tax than in previous years. PhilHealth provides health and hospitalization subsidies to its members should they or their dependents be hospitalized.

To estimate the impact of the TRAIN Law on your compensation income click here. Get the annual gross income. This income tax calculator only provides an estimate according to the most common scenarios for salary standard employment income that comes from an employer.

Tax Calculator Philippines is an online calculator you can use to easily compute your income tax and other miscellaneous expenses that comes with it. Net taxable compensation and business income of resident and non-resident citizens resident aliens and. Your tax bracket and the income threshold for your taxThe calculation on the.

Tax calculator We also provided a simple tax calculator below. This tool is built so more Filipinos. Multiply the gross income by 8 to compute the income tax due.

It is mainly intended for residents of the US. Total Annual Tax Due Php 25000 Less. Taxable income band PHP.

It provides employees with a practical means of paying for. Tax brackets and tax thresholds have changed in 2019. The philippines income tax calculator uses income tax rates from the following tax years 2022 is simply the default year for this tax calculator please note these income tax tables only include.

Total Creditable Tax Php 2517585 Tax Refund Php 17585 Based on the information above the employer over-withheld an. If you are self-employed. Income Tax 2200245 12 250000 020 12 2640294 250000 020 12 280588 12 Income Tax 23382 All thats left is to subtract your income tax from your.

And is based on. Sweldong Pinoy is a salary calculator for Filipinos in computing net pay withholding taxes and contributions to SSSGSIS PhilHealth and PAG-IBIG. Your household income location filing status and number of personal exemptions.

Php 15000 x 12 months Php 180000. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Income Tax Calculator Philippines Who are required to file income tax returns.

Php 180000 x 008 Php 14400. Philippine Public Finance and Related.

Taiwan Tax Faq Foreigners In Taiwan 外國人在臺灣

Resources Uric Tax Accountants

Free Tax Reform Calculator Philippines Sprout Solutions

Salary Paycheck Calculator Calculate Net Income Adp

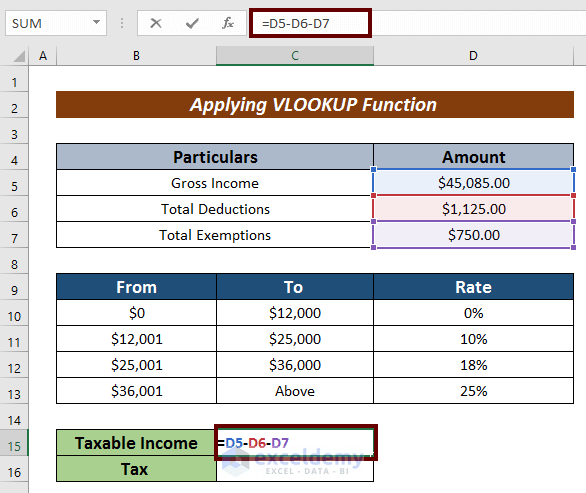

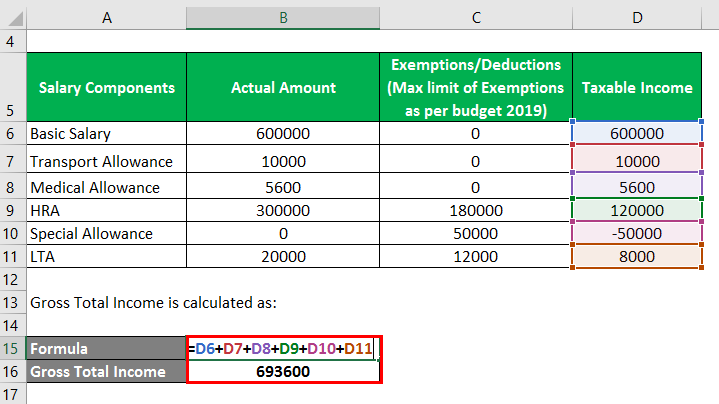

Income Tax Formula Excel University

Income Tax Calculating Formula In Excel Javatpoint

Sharing My Tax Calculator For Ph R Phinvest

How To Calculate Hypotax Eca International

Philippines Sales Tax Rate Vat 2022 Data 2023 Forecast 2006 2021 Historical

How To Compute Income Tax In The Philippines An Ultimate Guide Filipiknow

Excel Formula Basic Tax Rate Calculation With Vlookup Exceljet

Bir Tax Calculator Factory Sale 57 Off Oldetownecutlery Com

Tax Calculator Compute Your New Income Tax

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Formula For Calculating Withholding Tax In Excel 4 Effective Variants

Taxable Income Formula Calculator Examples With Excel Template

:max_bytes(150000):strip_icc()/dotdash_Final_Net_of_Tax_Dec_2020-98efd407350341fdb178949dadd84c5c.jpg)