st louis county personal property tax waiver

1340 E 9th Street Realty Corp Et Al v. Duplicate personal property tax receipts are available either by mail online at the Saint Louis County Collector of Revenues Office in Clayton or at any of the Saint Louis County Government satellite offices.

Title Deed Of Trust St Louis County

Personal property tax waivers Personal property accountstax bill adjustment add or remove vehicle Pay taxes EXCEPT for delinquent real estate taxes 2017 and older.

. All Personal Property Tax payments are due by December 31st of each year. Daly Collector of Revenue 1200 Market Street Room 109 St. Charles County on January 1 of the required tax year.

You may be entitled to a tax waiver if one of the following applies. The charge for a duplicate receipt by mail or at the Collectors office is 100. You can pay your current year and past years as well.

Louis MO 63129 Check cash money order Check cash money order M F. Louis real estate tax payment history print a tax receipt andor proceed to payment. Charles Mo 63301 636-949-7422 1-800-822-4012 ext.

If you have any questions you can contact the Collector of Revenue by calling 314 622-4105 or emailing propertytaxdeptstlouis-mogov. Obtain a Tax Waiver Statement of Non-Assessment Residents with no personal property tax assessed in the prior year can obtain a statement of non-assessment tax-waiver Obtain a Real Estate Tax Receipt Instructions for how to find City of St. You did not own any personal property on January 1st of the prior year.

8am 430pm M F. The full name of this company is e name. Our address is the present one.

Louis County Assessors Office is responsible for accurately classifying and valuing all property in a uniform manner. Brent Johnson Assessor Greene County. Gail McCann-Beatty Assessor Jackson County.

You will be asked to present one of the following documents. What Do I Need To Get A Personal Property Tax Waiver In St Louis County. Pay your current or past real estate taxes online.

A tax waiver is only used to license a vehicle motorcycle trailer or other assets. Leave this field blank. Certificate of Title properly signed over to you with sellers signature purchasers.

Charles County assessment records there are no personal property taxes due for a specific person business or corporation for the specified tax year. Obtaining a property tax receipt or waiver. The Collector efficiently manages this complex and overlapping taxing environment by offering a centralized process to expedite the receipt and distribution of over 24 billion annually for personal property taxes real estate property taxes railroad taxes utility taxes merchants taxes and manufacturers taxes.

First Time Personal Property Owners. What Do I Need To Get A Personal Property Tax Waiver In St Louis County. For assistance please call the phone number listed below.

Pay your personal property taxes online. Per Missouri Revised Statute 137122 property is placed in service when it is ready and available for a specific use whether in a business activity an income-producing activity a tax-exempt activity or a personal activity. Get in touch by phone number.

One can only obtain a Tax Waiver in person at the Assessors Office. You moved to Missouri from out-of-state. Even if the property is not being used the property is in service when it is ready and available for its specific use.

Charles County Assessor Sco Shipman 201 N. Michael Dauphin Assessor City of St. Place funds in for an inmate in the St.

Send your payments to. Its quick and easy. In the three years preceding this I used to address it on January 1st.

Louis Property LLC Steve Korenblat v. Search by Account Number or Address. Louis assessor if you did not own or possess personal property as of January 1.

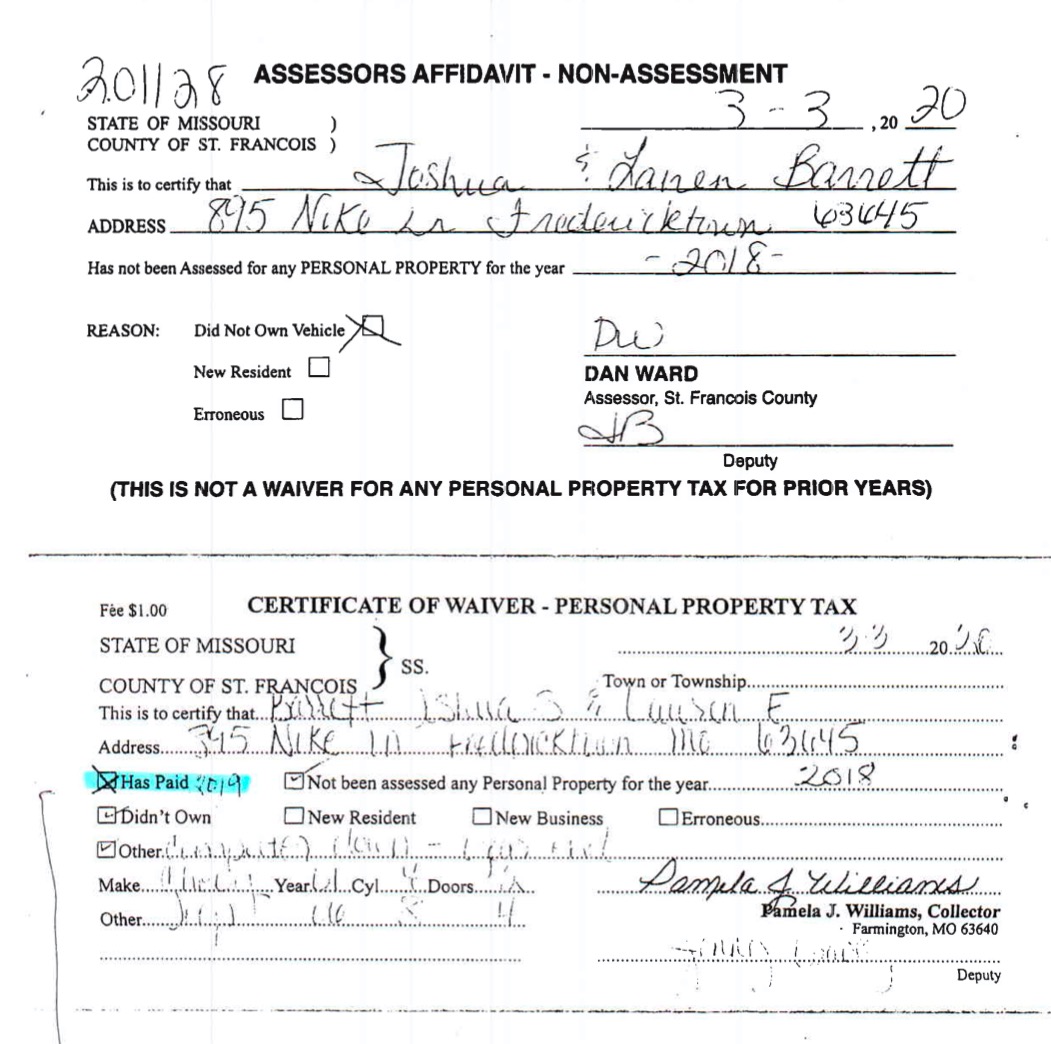

Locate print and download a copy of your marriage license. A waiver or statement of non-assessment is obtained from the county or City of St. You will need to contact the assessor in the county of your residence to request the statement or non-assessment and to be added to the assessment roll for the subsequent tax year.

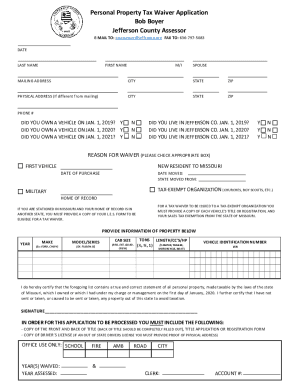

Certificate of Value Disabled POW Real Property Tax Exemption New Resident Personal Property Declaration. Steps to determine if you need a Certificate of Non-Assessment PDF A Certificate of Personal Property Non-Assessment indicates according to St. Business Personal Property Declaration Manufacturing Equipment Personal Property Declaration Depreciation Schedules FAQs Recovery Tables Business Personal Property Registration Merchant or Manufacturer License.

Personal Property Tax Declaration forms must be filed with the Assessors Office by April 1st of each year. Where do I pay personal property tax in St Louis. Personal property taxes are levied annually against tangible personal property and due upon receipt of the tax bill but no later than December 31st.

Personal Property Tax Waivers - St. We are committed to treating every property owner fairly and to providing clear accurate and timely information. Personal Property Tax Payment The Personal Propety Taxes are due no later than December 31 of each year.

Louis officials estimated that if property values remained the same and there were no mechanism to replace lost revenue personal property tax revenue to the city would drop from nearly 164 million in 2020 to 492 by 2026. To declare your personal property declare online by April 1st or download the printable forms. Missouri State Statutes mandate the assessment of a late penalty and interest for taxes that remain unpaid after December 31st.

You may also pay your taxes by mail. From prior three years address for January 1 of this year is here. 8am 430pm Services Offered.

Your feedback was not sent. Review the steps to obtain a tax waiver. We look forward to serving you.

Request for Business Personal Property Waiver St. The address you have is the current one. You are in the military and your home of record is.

First licensed asset you have ever owned. Payments can be made in person at 1200 Market Street Room 109. Certificate of Non-Assessment Tax Waiver Request Form.

A new Missouri resident. Please see FAQs for. Scan the side of your ID or take a 360-degree photo.

Can you be a real estate agent and mortgage broker in Ontario. You may be entitled to a personal property tax waiver if you were not required to pay personal property taxes in the previous year s. A Certificate of Personal Property Non-Assessment may be obtained if you did not own a vehicle in St.

An individuals name is their full name. Take a sideways photo and scan on both sides of your ID.

County Assessor St Louis County Website

Barrett S Problems Compounding In 3rd District Senate Race

Saint Louis County Final Lien Waiver Form Missouri Deeds Com

St Louis County Board Approves Waiving Penalties For Late Property Tax Payments Fox21online

Saint Louis County Final Lien Waiver Form Missouri Deeds Com

Waiting On Your Tax Bill St Louis County Says Printing Issue Delayed Mailing Vendor Says County Sent Files Late Politics Stltoday Com

Sales Use Tax Credit Inquiry Instructions

2019 Form Mo Personal Property Tax Waiver Application Jefferson County Fill Online Printable Fillable Blank Pdffiller

Personal Property Declaration St Louis County Fill And Sign Printable Template Online Us Legal Forms

Collector Of Revenue St Louis County Website

A Midas Touch Home St Louis Missouri

County Assessor St Louis County Website

Job Opportunities St Louis County Missouri Careers

Print Tax Receipts St Louis County Website